THE KEYS TO SUCCESS

Research

Relationships

Results

Serving High Net Worth Private Clients and Institutional Platforms

PUTTING YOUR PORTFOLIO FIRST

Princeton Capital Management delivers portfolio solutions that help give our clients peace of mind.

Research

“Research is the key to success in actively managing a client’s portfolio. Our forward-thinking investment approach anticipates innovation, disruption and change.”

–Al Berkeley, Chairman

- Intellectual capital is our strength

- Senior portfolio management team averages 30+ years of experience

- Risk management is a top priority

- Conduct in-depth research on capital markets and individual securities

Relationships

“Our clients’ interests always come first, and we listen carefully to understand your unique circumstances.”

–Joe Cajigal, CEO

-

Build an enduring relationship with a trusted advisor who provides you with peace of mind

-

Customized portfolio construction to meet specific needs

-

“Family office”-type personalized service quality

-

Timely and informative updates

-

Firm legacy of client retention

Results

“How our client defines success is our benchmark. While absolute performance metrics are important, the client experience and delivering successful outcomes really matters the most.”

–Hugh Fitzpatrick, President

- Track record of past success

- Designed to deliver high risk-adjusted returns

- Client interests always come first

- A highly-satisfied clientele drives our referral growth

“Wisdom never goes out of style.”

– James Fitzpatrick, Founder (1923 – 2016)

Why Choose Princeton Capital

Customized comprehensive portfolio management

Proprietary research

and analysis

Tax

efficiency

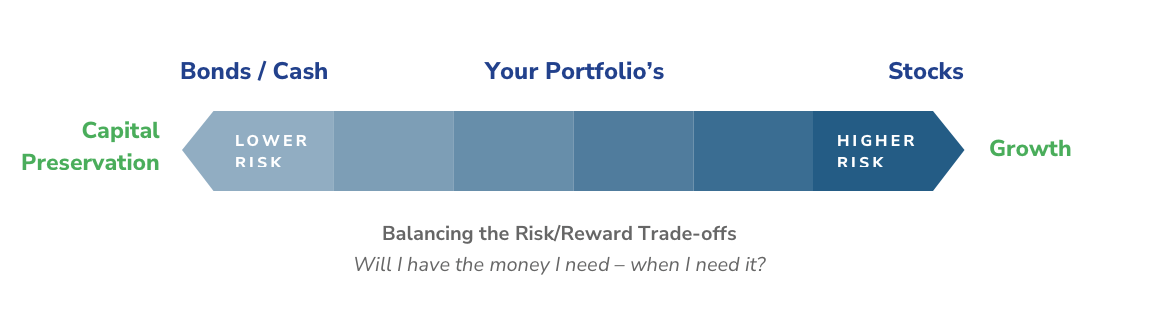

Outcomes: have the money you need – when you need it

An experienced

team of portfolio

managers

Access to

your advisor

A fiduciary commitment to act in your best interests

Culture

of integrity

PUTTING YOUR PORTFOLIO FIRST

Princeton Capital Management conducts in-depth research on capital markets and individual securities to build a portfolio that meets each client’s specific goals.

Experienced Investment Team

- 7-person investment team – averaging 30+ years of experience

- A separate account equity portfolio manager

- Veteran portfolio managers and analysts with deep industry experience

- Insight gained from experience, skill, and focus

- Clear and consistent investment philosophy

- Clearly defined decision-making process

- Transparent

- Complete access to portfolio managers

- Invested in the strategies we manage

Core Strengths

- Independent, SEC-registered investment boutique firm with origins in 1988

- A partnership culture, employee-owned

- Demonstrated value add

- Thematic and fundamental investment approach

FIRM PROFILE

Time-Tested Investment Strategies

“Risk is inversely related to diligence,

knowledge, and understanding.”

– James Fitzpatrick, Founder (1923 – 2016)

What Makes

Princeton Capital

Different and Better

Forward Looking

Focus on change reflected in our view of tomorrow

“Smart” Targets

Dynamic growth companies that are innovative, disruptive or scientifically advanced

Risk Managed

Optimal portfolio diversification benefit

Organizational Stability

Investment team has worked closely with one

another for decades

HNW Private Client Investment Strategies

PROTECTION, INCOME AND DIVERSIFICATION FOR YOUR PORTFOLIO

Portfolio construction designed to meet each client’s specific goals

Portfolio adjusts to changing market, fiscal and geo-political conditions or your circumstances

Institutional Platform

Core Equity

Enhanced risk-adjusted rates of return

Outperformance vs. market benchmark over a market cycle

Investor profile

Wealth preservation focused, conservative equity investment strategy

Universe

Liquid US equities:

Emphasis on large-to-mid cap companies with limited enterprise risk

A blend of growth and dividend paying equities

Cash and equivalents employed for tactical purposes

Critical stock selection factor

Conservative valuation relative to perceived opportunity

Growth Equity

Superior, long-term returns by investing in primarily US companies with significant prospects for growth

Investor profile

An unconstrained, all-cap strategy that seeks superior long-term returns with less concern for short-term volatility

Universe

US equities:

Innovative companies that are both well managed and well positioned to leverage secular demand trends

Established companies as well as fast growing, young and dynamic businesses

Broad definition of growth: revenue, cash flow and/or earnings

No market capitalization or industry bias

Critical stock selection factor

Sustainability of growth attributes